Competitive Rates , Flexible Tenure, Higher Eligibility and Collateral Free Loan & Overdraft Solutions for Your Business !

Get best out of your property by exploring our Loan Against Property Solutions

Property Loans Available

CapitalFin.in is a leading lending marketplace offering a variety of loan services for businesses and individuals. Based in Delhi, we work with top banks and NBFCs to cater to customers nationwide.

40+

500+ satisfied customers

Trusted by Many

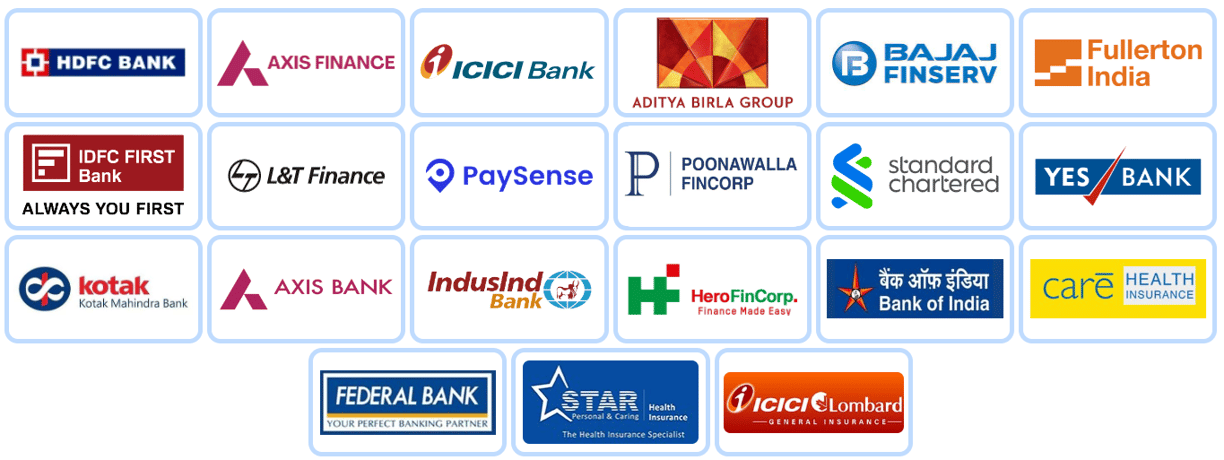

Reliable Partners

Associated with the Top Banks and NBFC's

We are extremely satisfied with their service! It exceeded my expectations with its quality and performance. Highly Professional and Knowledgeable team. I highly recommend this to everyone.

Vineet Gaur, V R Enterprises

★★★★★

Testimonials

Got Professional OD sanctioned and disbursed for us with in the record time!

★★★★★

CS Ankit Jindal

They helped us arrange business loans for our working capital needs with in 5 days and very low rate of interest

★★★★★